UAE introduced a mandatory Unemployment Insurance Scheme that came into effect on January 1, 2023. The deadline to subscribe to the job loss scheme is June 1. The grace period ends on 30 June, and those who fail to subscribe will be subject to fines.

Also Read: UAE Golden Visa: Criteria, Fees & Everything You Need To Know

What is the unemployment insurance scheme?

The Unemployment Insurance scheme is a form of insurance/social security that provides Emiratis and residents working in the federal and private sectors, financial support if they lose their jobs, as a result of termination by their employers. It aims to ensure continued decent living for the unemployed and achieve a competitive knowledge economy by attracting and retaining the best international talent.

The Unemployment Insurance scheme is a form of insurance/social security that provides Emiratis and residents working in the federal and private sectors, financial support if they lose their jobs, as a result of termination by their employers. The financial support will be given in exchange for a monthly insurance premium paid by the worker during his employment.

Also Read: UAE Ranked Second Best Destination In The World For Expats To Start A New Life

Who is eligible for the unemployment insurance scheme?

The scheme applies to all workers in the private and federal sectors except:

- investors, business owners who own and manage their businesses themselves

- domestic workers

- employees on a temporary basis

- juveniles under the age of 18

- retirees who receive a pension and have joined a new employer.

How much does the insurance cover cost?

Workers with a basic salary of AED 16,000 or less will need to pay a monthly insurance premium of AED 5, i.e. AED 60 annually. The compensation for this category must not exceed a monthly amount of AED 10,000.

Those with a basic salary exceeding AED 16,000 will need to pay AED 10 per month, i.e. AED 120 annually. The compensation for this category must not exceed AED 20,000 monthly.

Who pays for the insurance coverage?

The worker may choose to pay the premium on a monthly, quarterly, half-yearly, or on an annual basis. The insured worker may, in coordination with the insurance company, subscribe to additional benefits in addition to the above basic package. The value of the insurance policy is subject to VAT.

Is it mandatory for everybody who works in the UAE?

No, it is not. Investors who own the businesses where they work, domestic helpers, part-time employees, those under the age of 18, and retirees who receive a pension but have started a new job are not covered by the insurance program.

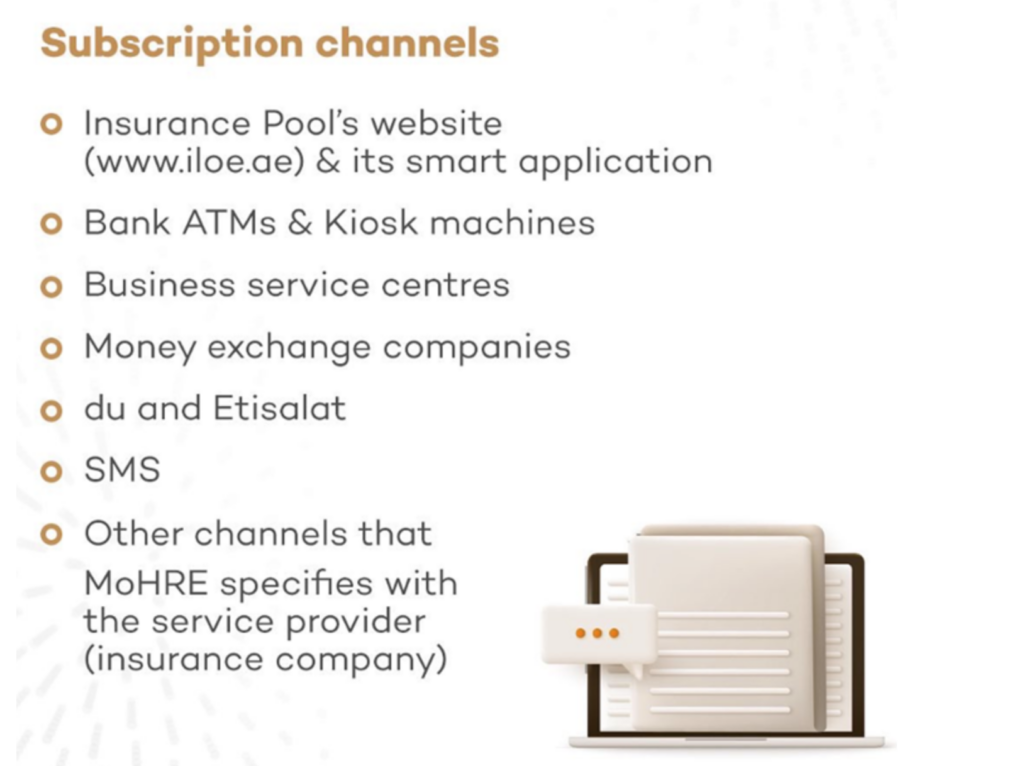

How do I subscribe to the scheme?

All federal government and private sector employees must subscribe to the new social security support programme by June 30. Employees can subscribe to the insurance programme in a number of ways, including through the insurance pool’s website and its smart application, as well as bank ATMs, kiosk machines, business service centres, money exchange companies, du and Etisalat or by SMS, the ministry said.

Also Read: Schengen Rules For Residents: Everything You Need To Know

1 Comment