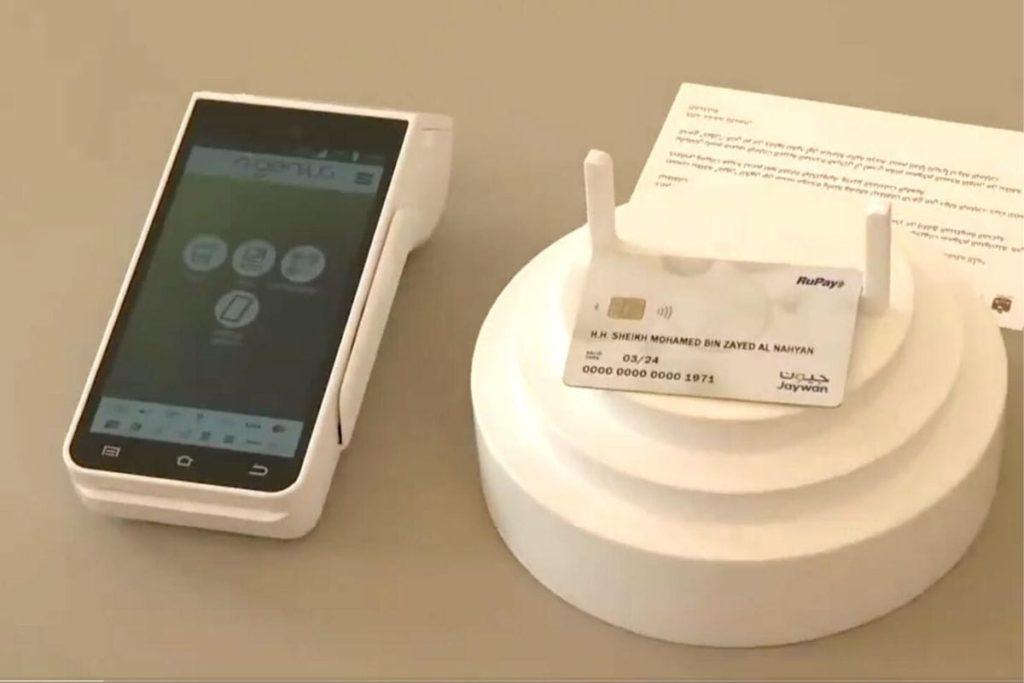

The UAE is set to introduce a groundbreaking domestic payment system, Jaywan, which aims to change the financial landscape starting this September. By the end of August, over 90% of Point-of-Sale (POS) terminals and 95% of ATMs across the UAE will be equipped to handle Jaywan cards. This new system, developed by Al Etihad Payments, a subsidiary of the Central Bank of UAE, will begin rolling out to the public by the end of the third quarter and pick up pace in the fourth quarter.

A Streamlined Payment Solution

Jaywan cards will be available as debit or prepaid cards, offering UAE residents a cost-effective alternative to international payment systems like Visa and Mastercard. By the end of August, more than 90% of POS terminals will be ready to accept Jaywan cards, while 95% of ATMs will support Jaywan card withdrawals and related services. These milestones ensure a smooth transition to Jaywan, allowing consumers to adopt and benefit from the new system quickly.

“Right now, we are at the 40% mark on Point-of-Sale terminal readiness, which will grow each week. In August, we will get to 95%,” said Jan Pilbauer, CEO of Al Etihad Payments. “We want the platform to be ready before we give the green light to issuers to start sending out the Jaywan cards to users at scale. This way, there can be no negative consumer experience.”

Also read: Burj Khalifa Summer Camp Offers Exciting Adventures For Kids

No Fees for Users

Banks and local exchange houses will issue Jaywan cards free of charge.

Boosting the Local Economy

The introduction of Jaywan is expected to benefit the UAE economy. Jaywan’s domestic payment solution lowers card processing costs, enhancing efficiency for consumers and businesses. Its competitive fee structure boosts local adoption and usage.

“With Jaywan, we wanted to create something that everyone in the UAE could be proud of,” said Pilbauer. “It brings financial stability and ensures that we have solid domestic payment solutions serving the needs of the UAE. The second objective was to be more efficient with what we have created domestically.”

Global Reach with Local Benefits

Jaywan, designed primarily for domestic use, will also provide international functionality. Banks in the UAE will be able to issue standalone Jaywan cards or co-badged cards featuring Jaywan and other international card schemes like Visa or Mastercard. This co-badging will allow cardholders to make payments outside of the UAE, providing flexibility for travelers.

In time, Al Etihad Payments will secure agreements with global payment authorities, enabling Jaywan cardholders to transact abroad,” Pilbauer explained.

Looking Ahead

As the rollout of Jaywan progresses, there is potential for the introduction of a Jaywan credit card, although this will depend on market demand and the success of the initial launch. “There are domestic card schemes in other countries evolving and offering a credit product. That may be a future path for Jaywan – but not for now,” Pilbauer added.

A Bright Future for Jaywan

The launch of Jaywan represents a significant step forward for the UAE’s financial infrastructure. Jaywan aims to be a cornerstone of the UAE’s economy with its robust, efficient, and cost-effective payment solution. Extensive preparations and a phased rollout promise a smooth transition, with full benefits expected soon.

As UAE ATMs and POS terminals integrate Jaywan-readiness and prepare to issue over 8 million cards, the new payment system aims to boost financial stability and efficiency. This initiative highlights UAE’s dedication to advanced financial solutions that meet resident needs and support economic growth.

Also read: Get Ready For Heart-Pounding Action At Taif Summer Race Night 2024

Leave a comment